how are property taxes calculated in pasco county florida

Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill. Taxable Value x Millage.

Are Big Property Value Increases Going To Mean Big Tax Increases

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax.

. This simple equation illustrates how to calculate your property taxes. Assessed Value - Exemptions Taxable Value. Search all services we offer.

Click Here for More. TAX COLLECTOR PASCO COUNTY FLORIDA Thank you for allowing us to serve you Menu. Choose Your Legal Category.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account. TAX COLLECTOR PASCO COUNTY FLORIDA Thank you for allowing us to serve you Menu. My team and I are committed to exceptional service fairness and accuracy.

Please visit our records search page locate your property then click on the Estimate Taxes link at the top. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Money from property tax payments is the cornerstone of local neighborhood budgets.

Along with Pasco County they rely on real property tax receipts to support their operations. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax also known as real estate tax in Pasco County is 136300 per year based on a median home value of 15740000 and a median effective property tax rate of.

Thank you for visiting your Pasco County Property Appraiser online. The basic formula is. Please note that we can.

For comparison the median home value in Pasco. These are deducted from the assessed value to give the propertys taxable. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

Pasco County collects on average 087 of a propertys. To calculate your taxes we first need to locate your property. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value.

Pay Your Property Taxes Online Here. The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400. Pay Your Taxes Online.

Home Pasco County Property Appraiser

Dscr Loans In Pasco County Florida No Doc Way To Build Your Real Estate Portfolio Quickly

Aug 23 Voter Guide Property Tax Increase For Duval Schools Jacksonville Today

Pasco County Appraiser Fill Out Sign Online Dochub

Florida Sales Tax Rates By City County 2022

Penny For Pasco Pasco County Fl Official Website

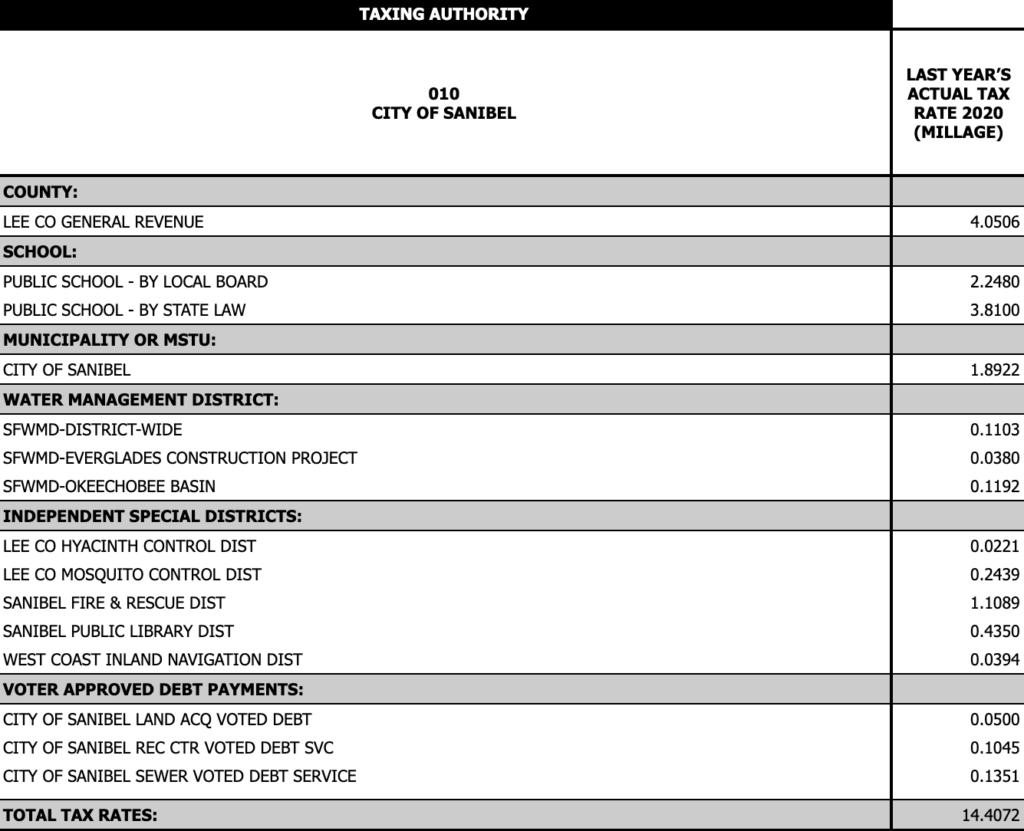

Property Taxes In Southwest Florida

What Is Florida County Tangible Personal Property Tax

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Taxes Columbia County Tax Collector

Home Pasco County Property Appraiser

David Weekley Homes Truman Ii Th Lot 4 Block C Homes For Sale In Land O Lakes Pasco County Fl

Florida Sales Tax Calculator Reverse Sales Dremployee

Florida Property Taxes Explained

2022 Best Places To Buy A House In Pasco County Fl Niche

Pasco Commissioners Keep Property Tax Rates The Same So Expect A Bigger Bill